On October 18, 2017, President Juan Carlos Varela passed one of the most important Panama real estate tax reforms of the last 40 years which adjusts to the current market prices for homes and properties. As Panama Real Estate Law Firm we want to provide you with the best information about this new law.

After its legislative process, Bill 509 was given full approval in September 2017 by the Legislative Chamber and passed for approval of the President, resulting on new real estate tax Law 66 of 2017. The new tax rates are effective on January 1st, 2019.

Higher Tax Exemptions

Law 66 of 2017 establishes new tax rates for individuals and companies that can prove, according to each case, the use given to the property. The two categories in which properties can fit are familiar patrimony or primary residence. For each category, depending on the individuals that reside in them, the requirements will vary.

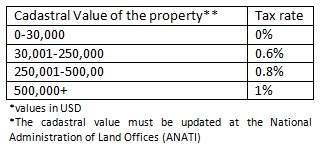

The exemptions from property tax for both categories are the same, higher than the ones contained on the tax code which related more to the market prices of the years 1980-1990. According to Law 66, the new rates will be:

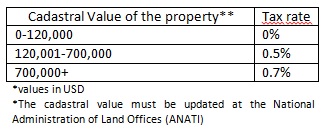

For commercial and industrial properties the rates will be:

Why the new property tax law?

The property tax rates used until 2018 were created based on the price properties had on the past millennium. There was a clear need for these rates to be modified in order to promote tax collection and rise the national economy. There is also a theory that President Varela has made it a target to formalize the titling of properties across the country. At the moment, much of the land in Panama is untitled and simply held under laws of possession, but also: untaxed.

The vast majority of landholdings in Panama fall under the $120,000 threshold, the move should help correct this “informal” system and allow a systematic formal land holding — and accounting — regime, including better protections for owners with titled land.

Panama has been under pressure from the World Bank and other lending institutions to collect the millions of dollars of unpaid property taxes that owners do not usually pay until it is time for them to sell – often using the deposit on the real estate transaction to pay the property taxes as you are not able to transfer the title to the new owner until you pay the tax.

Alcogal – Panama Real Estate Law Firm

Alcogal is the firm of choice for some of the nation’s largest real estate industry developers and operators. We provide a full range of transactional, regulatory and litigation services to support these clients.

The depth of our experience, breadth of our industry contacts, and understanding of the varied marketplaces in which our clients do business enable us to bring a “market-aware,” result-oriented approach to our client’s business needs. Our industry understanding results in a high level of client satisfaction.

We are the best Panama Real Estate Law Firm, contact us.