Our capital markets team recently advised Banco Nacional de Panamá in connection with its USD1 billion Rule 144A / Regulation S bond issuance. This transaction is the first international bond issuance in the international capital markets of Banco Nacional de Panamá since its creation and represents the largest securities issuance that any Panamanian financial institution has made. This bond issuance also features the lowest-ever interest rate (2.5%) to be obtained by a Panamanian bank.

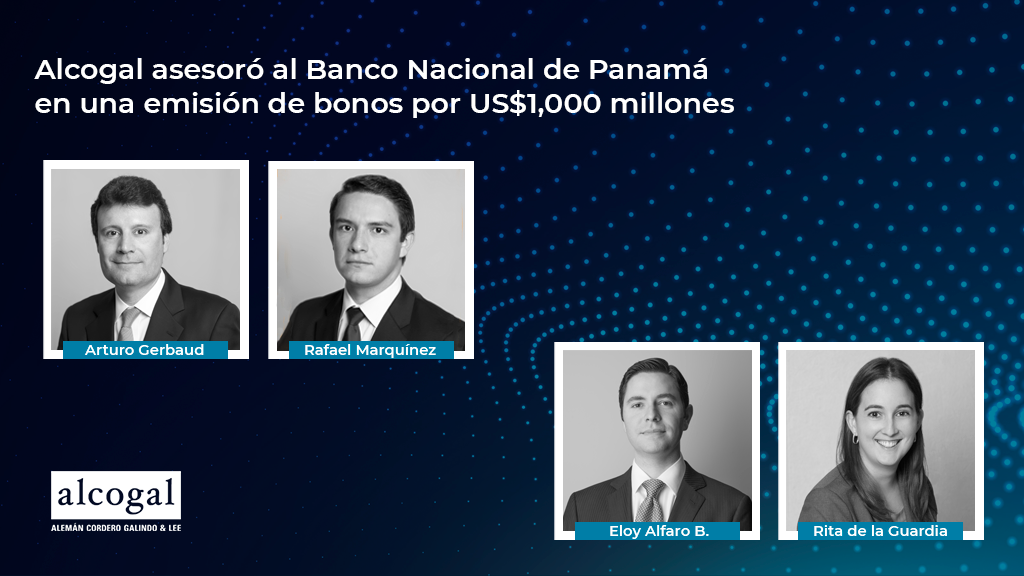

The team of lawyers that assisted Banco Nacional de Panamá was led by partner Arturo Gerbaud and senior associate Rafael Marquínez. Partner Eloy Alfaro B. and senior associate Rita de la Guardia also participated in this transaction, which closed on August 11th, 2020.