looking toward the future

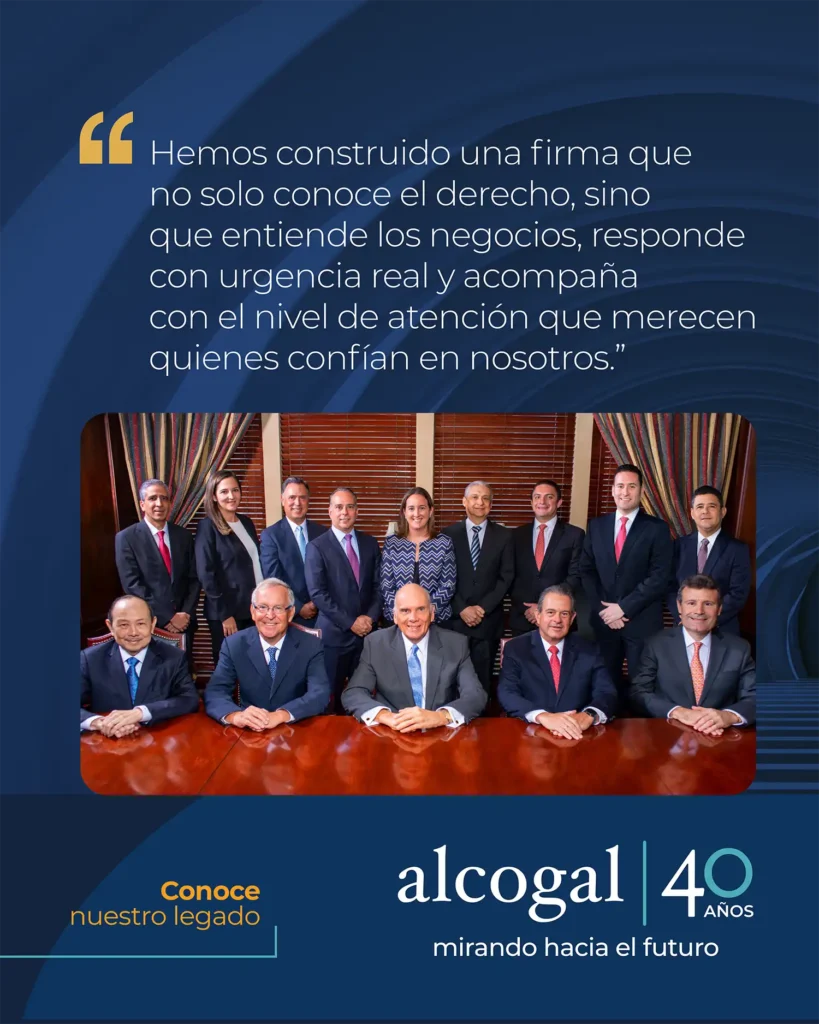

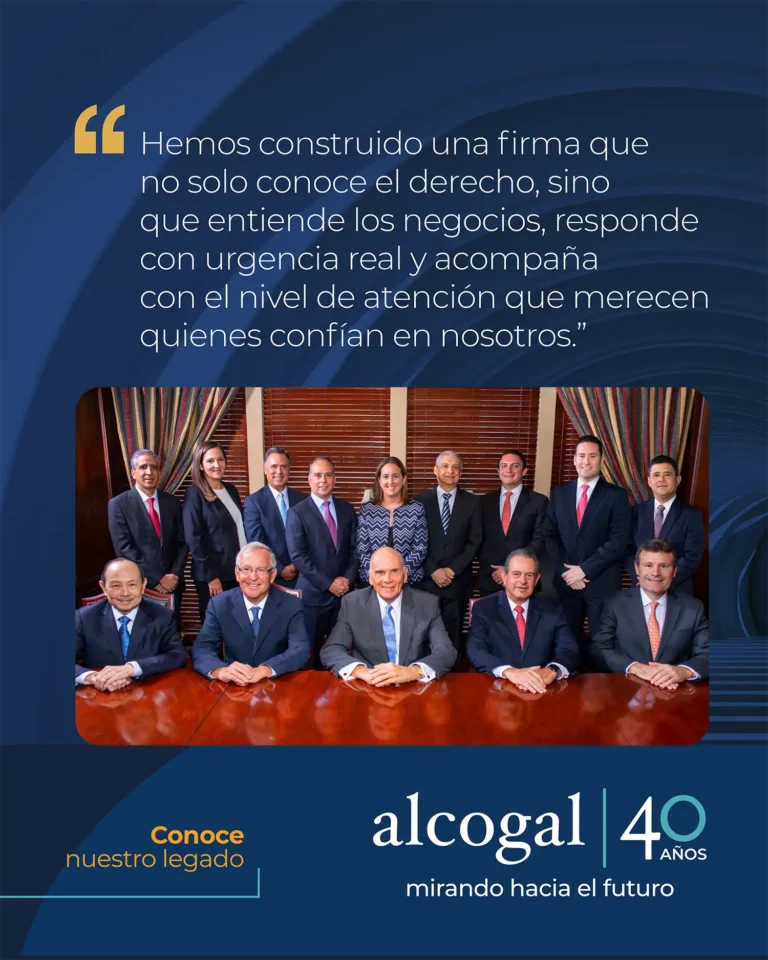

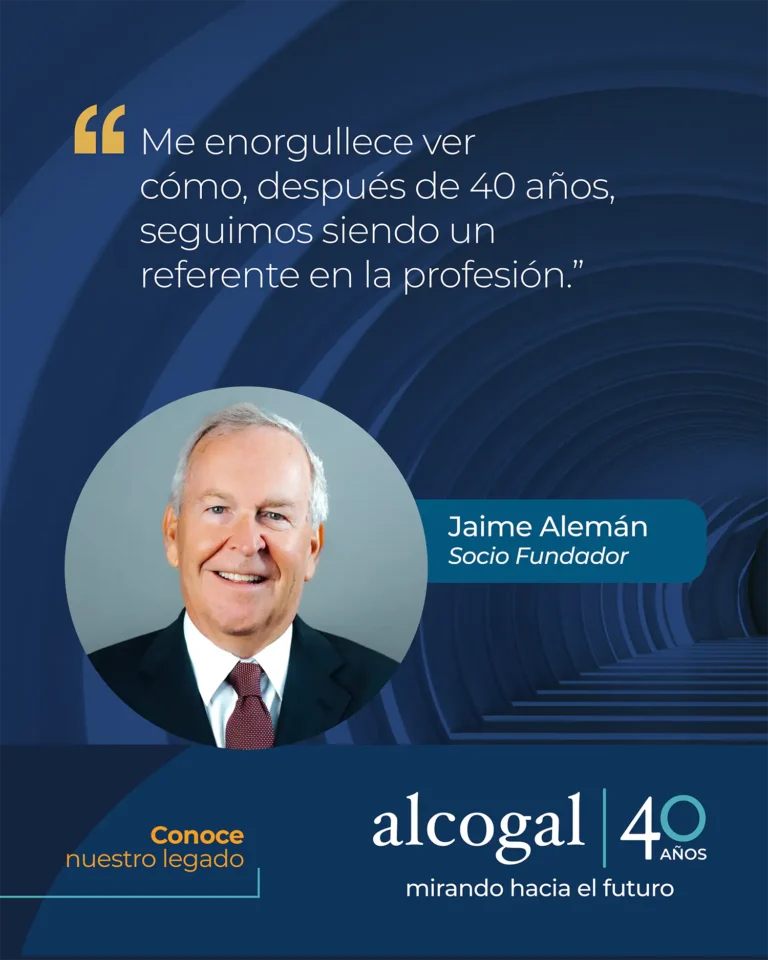

Founded in 1985 by partners with a clear vision, Alcogal has established itself as a leading law firm in Panama and the region. Our focus has always been on providing the highest quality legal services, guided by trust and excellence.

On this anniversary, we reaffirm our commitment to progress, innovation, and the strategic development of the country.

Celebrating 40 Years of Legal Excellence

Alcogal celebrates four decades of legal leadership, having played a key role in the country’s historic milestones. With over 200 team members, we reaffirm our commitment to evolving alongside our clients and building the future with integrity and excellence.

First Decade – 1985 to 1995

Global Growth: Making a lasting impact

During its first decade, Alcogal not only laid the groundwork for its international presence by opening offices in key jurisdictions across the Americas — including the Bahamas, Belize, and the British Virgin Islands — but also worked tirelessly to build strong relationships with many of our major corporate clients. This early effort proved essential, as 40 years later, these clients remain key pillars in our portfolio. Among our notable clients are Cable & Wireless Panama, Banco General, Banistmo, The Bank of Nova Scotia, and Citibank, among others. This strategic expansion marked the beginning of the firm’s strong commitment to a solid regional presence and a global vision. At the same time, our dedication to delivering exceptional service and understanding the specific needs of each client has allowed these relationships to endure and grow stronger over time.

1985 – We advised Banco General on the acquisition of part of Bank of America’s assets and loan portfolio in Panama.

1986 – We served as legal counsel in structuring the first syndicated loan agreement governed by Panamanian law. We represented a consortium of banks composed of Chase Manhattan Bank, Citibank, The First National Bank of Boston, Deutsche Bank International, Banco de Iberoamérica, and Banco del Istmo. The borrower in this transaction was Cervecería Nacional, setting a precedent in the evolution of corporate financing in Panama.

Second Decade – 1996 to 2005

1996 – We advised Evergreen on the concession of a port in Colón, a strategic transaction that strengthened the country’s maritime infrastructure and positioned Panama as a regional logistics hub.

1997 – We advised Cable & Wireless on the acquisition of 49% of INTEL’s shares, marking a milestone in the privatization of the telecommunications sector.

1998 – We were involved in the acquisition of Banco Ganadero by Banco Bilbao Vizcaya Argentaria (Panama).

2005 – We advised Banco General on the purchase of the assets and liabilities related to Fleet National Bank’s banking operations in Panama, which operated a branch in the country under the name BankBoston.

1996 – We advised the Cisneros Group on structuring a strategic alliance with The Coca-Cola Company, which marked the end of its commercial relationship with PepsiCo. As part of the agreement, Coca-Cola acquired 50% of the shares of Hit de Venezuela, the Cisneros Group’s bottling company, in a transaction valued at approximately USD 500 million (USD 300 million in cash and USD 200 million in assets). This transaction led to the creation of a joint venture called Coca-Cola y Hit de Venezuela. PepsiCo’s exclusion from the Venezuelan market subsequently triggered a legal process.

1998 – We represented Kansas City Southern Railroad in the privatization of Panama’s historic railway, facilitating its transformation into a key logistical corridor for global trade.

2000 – We advised on the merger by absorption of Banco Bilbao Vizcaya (Panama) and Banco Exterior, with the former remaining as the surviving entity and subsequently changing its name to Banco Bilbao Vizcaya Argentaria (Panama).

2005 – We represented Constellation Power in the sale of Panama Distribution Group to Ashmore Energy. Despite the change in shareholders, Ashmore requested that Alcogal remain as ENSA’s legal counsel, a role we have continued to fulfill without interruption.

Third Decade – 2006 to 2015

2007 – We advised PSA Panama International Terminal on the negotiation and drafting of the contract-law with the Panamanian government for the development and operation of a world-class port terminal.

2007 – We represented Citibank in its acquisition of Grupo Financiero Uno for approximately USD 1.3 billion.

2009 – We advised The Bank of Nova Scotia on the acquisition of the assets and liabilities of BNP Paribas, Panama Branch.

2010 – We were involved in the acquisition of BAC-Credomatic by Grupo Aval for approximately USD 1.9 billion.

2011 – We advised Icatech Corporation on the sale of Corredor Sur, one of Panama City’s main highways, to Empresa Nacional de Autopistas, S.A. (ENA), a government entity, for approximately USD 420 million.

2013 – Alcogal advised Banco Bilbao Vizcaya Argentaria on the sale of 100% of its shares to Grupo Aval, through its subsidiary Leasing Bogotá, Panama. The transaction was completed for a value of USD 646 million.

2006 – We advised Grupo Banistmo on the acquisition of Banistmo by HSBC, one of the most significant transactions in the banking sector in the region.

2007 – We advised Citibank on the acquisition of Grupo Cuscatlán for approximately USD 1.4 billion.

2010 – We advised Shell on the sale of its retail fuel distribution operation in Panama to Petróleos Delta.

2011 – We advised Icatech Corporation on the sale of Corredor Sur, one of Panama City’s main highways, to Empresa Nacional de Autopistas, S.A. (ENA), a government entity, for approximately USD 420 million.

2015 – We advised PSA Panama International Terminal on the drafting, negotiation, and execution of a new contract-law with the Republic of Panama.

Fourth Decade – 2016 to 2025

2016 – We advised AES on the financing for the construction of a liquefied natural gas-based power plant.

2019 – We advised Banco Panamá in connection with its acquisition by Banco Aliado through a merger valued at USD 210 million.

2020 – We advised AES Panama Generation Holdings, S.R.L. in connection with a corporate bond issuance of up to USD 1.4 billion and a loan facility of up to USD 105 million.

2021 – We advised Cable & Wireless Panama and its shareholder and operating partner, Liberty Latin America, on the acquisition of Claro Panama.

2023 – We advised ENSA in the negotiation of its collective labor agreement with the union representing ENSA employees, ensuring a successful and harmonious process.

2024 – We advised Grupo Bancolombia and a group of banks on the structuring of a syndicated loan for the acquisition of Grupo Éxito by Grupo Calleja, a landmark transaction in the region.

2024 – We advised Intervial Chile in the public bidding process launched by the Ministry of Public Works for Panama’s first Public-Private Partnership (PPP). The project aimed to rehabilitate and improve 246 kilometers of the Eastern Pan-American Highway.

2025 – We advised CPKC and Lanco Group/Mi-Jack on the sale of Panama Canal Railway Company (PCRC) to APM Terminals. Since the start of the concession in 1998, we have provided legal counsel to PCRC in all aspects of its operations, reflecting our long-standing commitment and the trust our clients place in our firm.

2017 – We represented Desarrollo Turístico Buenaventura in the development of “Buenaventura,” the largest and most exclusive beach and golf resort in Panama.

2020 – We advised Grupo Aval on the acquisition of 96.6% of the shares of Multi Financial Group Inc., parent company of Multibank Panama.

2021 – Alcogal advised Tocumen International Airport on a bond issuance of USD 1.855 billion, the largest ever issued in Panama at the time, aimed at financing the airport’s expansion and modernization.

2022 – We advised Grupo APC on the majority sale of APC Buró to Experian, one of the world’s leading credit risk companies.

2023 – Asesoramos a ENSA como deudor en un préstamo sindicado por USD 100 millones otorgado por BID Invest y Scotiabank, destinado a ampliar el acceso a la electricidad en Panamá.

2024 – We advised Microserfin and Banco General on the structuring and placement of the first Social Bond issuance in Panama.

2025 – We acted as legal counsel to The Bank of Nova Scotia in the transfer of its banking operations in Colombia, Costa Rica, and Panama to Banco Davivienda, in a transaction that marks a milestone in the regional financial sector.

Campaign Assets

Press Release

We celebrate 40 years of excellence as one of Panama’s most prestigious law firms. Founded by Jaime Alemán with a vision of excellence, integrity, and commitment, the firm has grown to over 200 team members and has closely accompanied the development of the country’s business and financial landscape. Since its inception, we have provided key legal counsel in sectors such as banking, infrastructure, and commerce, building a reputation grounded in trust and quality service.

Over the past four decades, Alcogal has played a fundamental role in landmark projects that have shaped Panama’s modernization—such as the expansion of the Canal, the privatization of telecommunications and railways, and the financing of Tocumen International Airport. The firm has also served as a strategic partner in the development of the Panama Pacifico Special Economic Area and continues to advise the country’s leading banks. Today, Alcogal reaffirms its commitment to the future, investing in innovation, the development of its legal talent, and excellence in client service.